Their responsibility is to maintain an inventory of items of the ETF and ensure investors can purchase and sell when they choose to take action. The market maker ensures there’s always a purchaser or seller for the investor at an accurate price. The ETF will track during the day the underlying holdings (ie. the stocks held in the Fund). ETF liquidity plays an essential position in making certain that market costs accurately mirror the value of the underlying securities. Liquidity permits frequent shopping for and selling exercise, permitting market members to swiftly act on value discrepancies between the ETF and its underlying value.

Though the liquidity of an exchange-traded fund (ETF) can seem advanced, it comes all the method down to recognizing that it goes beyond seen trading volume. It encompasses not only the buying and selling of the ETF shares themselves but also the liquidity of the underlying securities within the ETF’s portfolio. And it’s the vehicle’s unique creation and redemption process that gives it the depth of liquidity to dynamically reply to investor supply and demand.

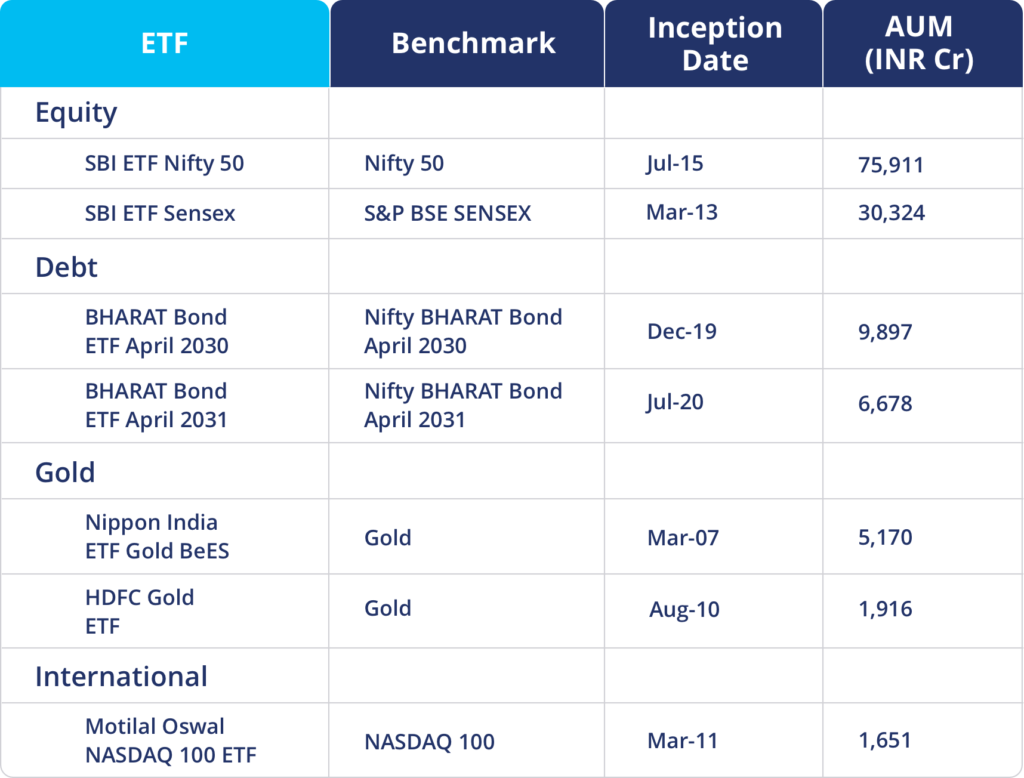

Analysis Etfs

To assess secondary market liquidity, follow an ETF at different occasions of day, over varied time durations, and notice how it’s affected by market environments. Some of the statistics you may wish to concentrate on include average bid-ask spreads, average trading volume, and premiums or discounts (i.e., does the ETF trade near its web asset value?). Fixed-income traders are involved that some bond ETFs could come against liquidity issues if the Federal Reserve were to hike charges and spark a significant sell-off in debt securities. The fixed-income market has been identified for its illiquid nature, however as bond ETFs have grown in size, extra institutional investors have turned to ETFs to easily enter and exit fixed-income positions. However in latest bond market corrections, segments of the junk bond market exhibited a widening gap Financial cryptography between the NAV and ETF share prices, diminishing returns for sellers. Many traders think that if an ETF doesn’t trade actively the fund is illiquid and ought to be avoided.

Verify Market Circumstances Before Trading

That query may make sense from the attitude of a single inventory. The hole between its bid and ask price could be extensive if a stock does not incessantly commerce. However with ETFs, you’ve two ranges of liquidity – that of the ETF and that of the underlying stocks.

And if you have https://www.xcritical.com/ questions around commerce execution, you probably can all the time contact the American Century Investments capital markets desk through your American Century Investments® or Avantis Investors® consultant. Bear In Mind, the volume of the ETF represents only what has been traded, not what could presumably be traded. From small to massive ETF trades, you can benefit from the ETF group of pros and the resources and tools they can provide. Their jobs are to help advisors in fulfilling their clients’ wants. The common day by day volume of an ETF reveals solely what has been traded, not what might have been traded. Commonly, the bigger and more heavily traded ETFs have tighter spreads.

- Second, the number of buyers and sellers helps enhance buying and selling quantity and therefore liquidity.

- Use our screener to identify ETFs and ETPs that match your funding targets.

- But no one mentioned you must trade with the seen bid/ask spreads.

- Vanguard ETF Shares are not redeemable with the issuing Fund apart from in very large aggregations worth tens of millions of dollars.

- To assess secondary market liquidity, follow an ETF at different times of day, over various time durations, and observe how it’s affected by market environments.

Five Misconceptions About Etf Liquidity?

Fund managers have to handle cash required to meet redemptions. Since underlying property are often offered to boost the cash essential to pay redeeming mutual fund holders there is a taxable event for all holders of the fund. Mutual funds typically take several days to settle and fund managers have leeway to apply premiums and discounts how to choose liquidity provider to NAV for flows in a non-transparent method. Second, the number of consumers and sellers helps improve trading quantity and hence liquidity. There are many drivers of this from investor interest in the strategy, attractiveness of future returns and even how well the ETF is marketed or bought.

The brief reply is that typically this should not be a concern to investors. Our closed-end fund benefits from world investment analysis that addresses the calls for of the ever-changing financial panorama. At Lazard, we provide a suite of differentiated funds that will help you discover the funding options that finest address your targets. IMC has positioned itself on the beating coronary heart of the expanding exchange-traded funds (ETF) ecosystem, acting as a lead market maker in additional than 150 US exchanges.

Low liquidity can be a risk as a result of traders may be pressured to merely accept less favourable costs. ETF liquidity has two components – the quantity of items traded on an change and the liquidity of the individual securities in the ETF’s portfolio. If demand for an ETF outstrips provide, the AP would borrow shares of inventory from an underlying benchmark and put them in a belief to form a so-called creation unit of an ETF. The trust offers shares of the ETF which might be authorized claims on the shares held within the ETF, and the AP exchanges the basket of stocks for ETF shares, which are bought to the public on the secondary market.

The two are often used interchangeably as a quantity of firms perform each roles within the ETF ecosystem. There’s a false impression that ETFs with excessive trading volumes are liquid, while these with low trading volumes are illiquid. If traded properly, buy and promote orders ought to have around the similar worth influence in share terms in all products, although bid/ask spreads will be wider from one ETF to another. However nobody stated you must trade with the visible bid/ask spreads. All investing is topic to threat, together with attainable loss of principal. Be aware that fluctuations in the monetary markets and different factors could cause declines in the worth of a client’s account.

Moreover, market makers will publish quotes past the seen liquidity for many ETFs. Market makers do this in order that larger-size trades can be executed while overlaying their prices of offering liquidity. An ETF may be traded like a inventory at any time during the trading day which is a giant difference between an ETF and a mutual fund. Mutual funds are priced as quickly as a day on the finish of the buying and selling day.